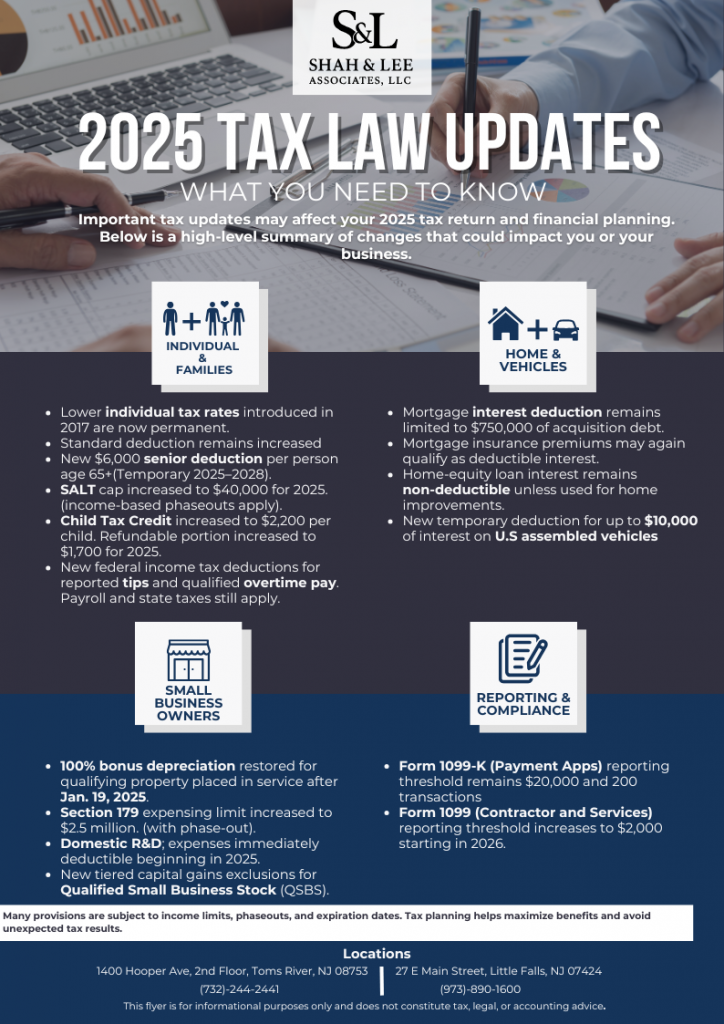

Federal Tax Brackets and Filing Strategy for 2025

Summary

Federal income tax brackets for 2025 reflect inflation-adjusted thresholds that may affect filing strategies, withholding, and estimated tax payments.

What Changed

-

Updated income thresholds for each federal tax bracket

-

Adjusted phaseouts for certain deductions and credits

Who Is Affected

-

Individual taxpayers across income levels

-

High-income earners

-

Taxpayers subject to phaseouts

What This Means

Understanding current tax brackets supports more effective planning and helps avoid under- or over-withholding during the year.

CTA

If you have questions about how these changes may affect you, please contact Shah & Lee Associates, LLC.

Source: IRS Inflation Adjustments

https://www.irs.gov/newsroom