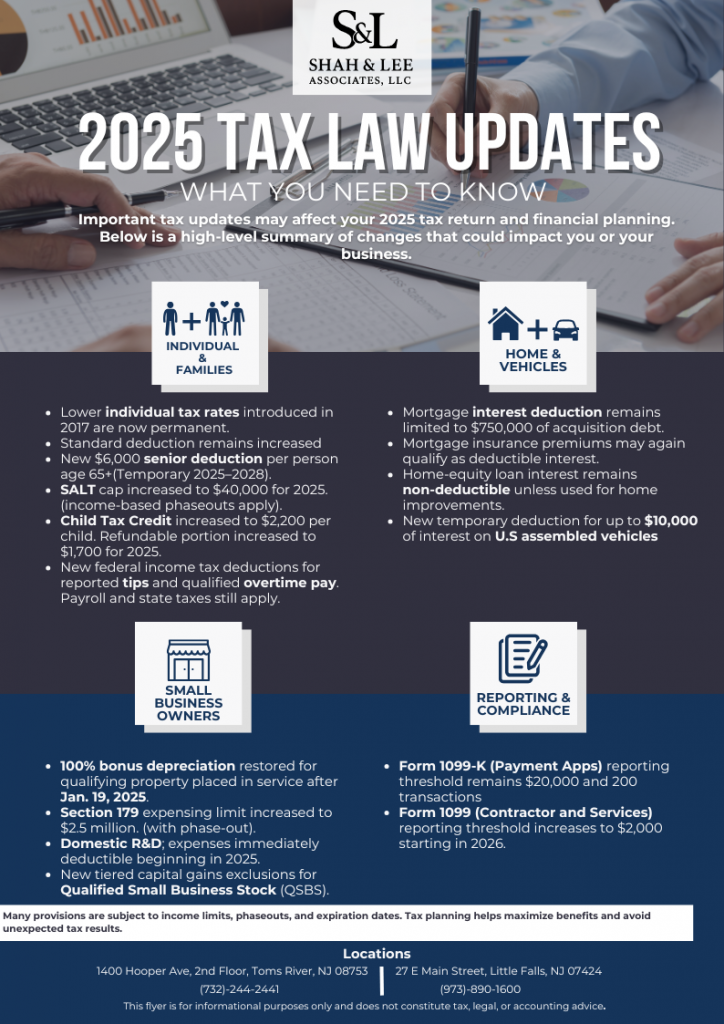

Federal Tax Inflation Adjustments for 2025

Summary

The IRS announced annual inflation adjustments affecting standard deductions, tax brackets, and other thresholds for 2025.

What Changed

-

Increased standard deduction amounts

-

Inflation-adjusted tax brackets

-

Updated thresholds for multiple tax provisions

Who Is Affected

-

Individual taxpayers

-

Families and households

-

Taxpayers making estimated payments

What This Means

These adjustments may reduce taxable income but may also require withholding or estimated tax reviews.

CTA

For tax planning assistance, contact Shah & Lee Associates, LLC.

Source: IRS Inflation Adjustments

https://www.irs.gov/newsroom