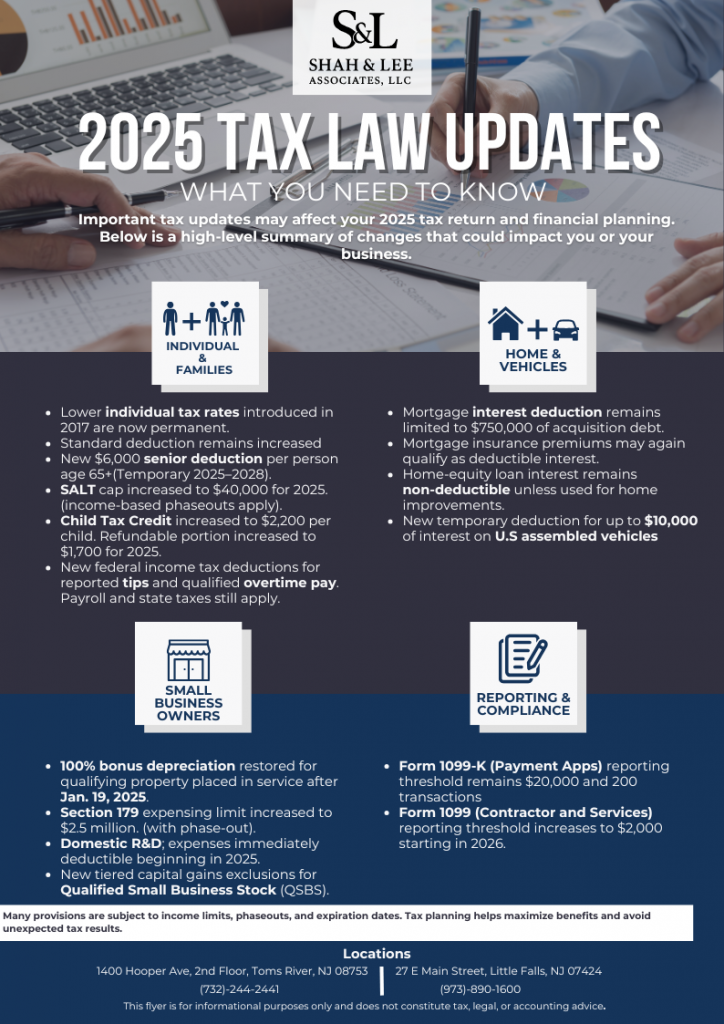

Federal Tax Brackets and Filing Strategy for 2025 SummaryFederal income tax brackets for 2025 reflect inflation-adjusted thresholds that may affect filing strategies, withholding, and estimated tax payments. What Changed Updated

IRS Notices and Credit Updates SummaryThe IRS released several notices clarifying tax credits, reporting relief, and retirement contribution limits for the 2025 tax year. What Changed Clarification of certain individual

IRS Payroll Withholding Guidance for 2025 SummaryThe IRS confirmed that federal withholding tables and major payroll forms remain unchanged for tax year 2025. What Changed No updates to federal withholding

New Jersey 2025 State Tax Updates SummaryNew Jersey released updated tax provisions for 2025, including changes to credits, limits, and filing guidance. What Changed Updates to the NJ Earned Income

Federal Tax Inflation Adjustments for 2025 SummaryThe IRS announced annual inflation adjustments affecting standard deductions, tax brackets, and other thresholds for 2025. What Changed Increased standard deduction amounts Inflation-adjusted tax

Expanded Deductions for Tips & Overtime (2025) SummaryRecent IRS guidance outlines deductions related to qualified tips and overtime compensation beginning in 2025. What Changed Guidance issued on treatment of qualified